By Joe Lambe

As people debate whether to vote for a half-cent Jackson County sales tax for medical research, Missouri ranked 16th for best state business tax climate.

That is because overall taxes in it are low, the Tax Foundation found in its recent ranking, lower than Kansas and most other states.

Jeff Pinkerton, a senior researcher with the Mid-America Regional Council, wrote a report on the ranking this month.

In another study, he reported that per capita yearly taxes in Missouri, including all forms of taxes, is $3,167 compared to $4,112 nationwide and $4,001 in Kansas.

On Nov. 5, Jackson County voters will decide whether to approve the sales tax to create a medical research institute on Hospital Hill and the tax is much debated.

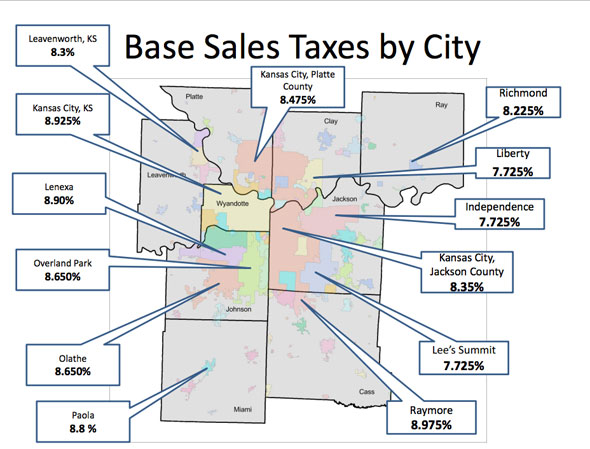

The Kansas City Star ran an article looking at various aspects of the tax, which would increase the base sales tax rate of Kansas City in Jackson County from 8.35 percent to 8.85 percent. That would still be less than some area cities and less than many other places.

But as in many places, that base rate does not cover higher sales taxes for the growing number of things like community improvement districts and transportation districts.

The CIDs allow up to one more cent of sales tax within project areas, and more than 33 have been approved in Kansas City since 2002.

Who’s talking