The city council finance committee today advanced a measure to put the critical city earnings tax to a public vote in April.

The city council finance committee today advanced a measure to put the critical city earnings tax to a public vote in April.

The full city council is expected to give final approval Thursday.

Then officials will campaign to keep the tax that funds 40 percent of a general fund budget, which mainly pays for public safety like police and firefighters.

Having to vote to approve the tax every five years is “atrocious public policy,” said City Attorney Bill Geary, but it forces citizens to think about the good of their city, and “maybe that’s a good thing.”

The city has had to vote to renew the 1963 tax since a 2010 statewide vote bankrolled by a mega rich St. Louis libertarian.

In Missouri, only Kansas City and St. Louis use the earnings tax. Kansas City voters renewed it by a wide margin in 2011.

If voters do not renew it this year, it phases out in 10 years.

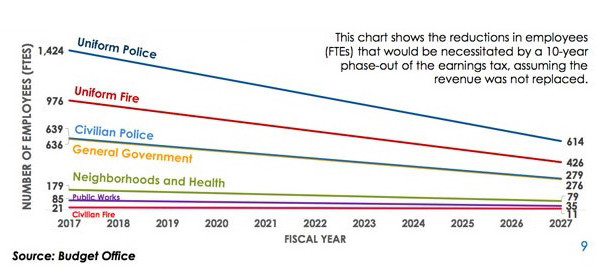

Randy Landes, Kansas City finance director, briefed the committee today on possible consequences.

The tax raises 22 percent of almost $944 million in governmental activities revenue, including 40 percent of the general fund revenue of about $532 million.

Almost 75 percent of the general fund goes for public safety, like the municipal court, police and firefighters.

Without vast changes to replace the earnings tax, the city would have to reduce costs by about $23 million a year each year for 10 years, Landes said.

Using just massive layoffs to do that, the number of police officers would decline from 1,424 to 614, he said.

Many increases in sales taxes and property taxes would need voter approval, he said, and if they go way up the tax burden on the old and poor will be heavier.

Half the earnings tax is paid for by non residents and retirees do not have to pay it at all.

Landes then introduced Geary, saying, “If I’m doom, he’s the doomer.”

Geary said the five-year renewal was nonsense but state lawmakers have declined city efforts to extend it.

In fact, he said, there are state bills pending that would end the tax entirely, one at the start of 2017 and one in 2019.

Councilman Kevin McManus said the tax is critical to strong cities that contribute to the strength of the state.

He thanked Landes and Geary for their reports.

“I like to still believe that facts matter so I hope some of these facts will help us,” McManus said,

I think at its core if the city doesn’t receive this revenue from the ET it will get it somewhere else. They will not lose the revenue. Where will they get it from? Not from increased sales taxes. That would give metro shopper more reason to not shop in KCMO. They’ll get it from raising property taxes.

1/3 to 1/2 of the people in KC during business hours do not live in KC. They use KC’s services from water to streets to emergency services. The ET is a mechanism that allows for these people to pay their fair share of the cost of their presence in our city. Without it, those costs would be paid by people who live in KC.

I don’t want to gain the 1% of my income back only to lose 2% to increased property taxes.