The city is in too much debt, is managing it well, but faces a crisis if voters do not renew the earnings tax next year.

The city is in too much debt, is managing it well, but faces a crisis if voters do not renew the earnings tax next year.

City finance officials gave details Tuesday in a public report to the mayor and city manager.

City debt is running steady at about at about $1.6 billion, much of it from 2006 to 2010 related to the Power and Light District and the Sprint Center.

The city is paying it off at about $85 million a year and will retire half of the current debt within a decade, said City Treasurer Tammy Queen.

But last fiscal year, about 13.6 percent of city revenues went for debt service.

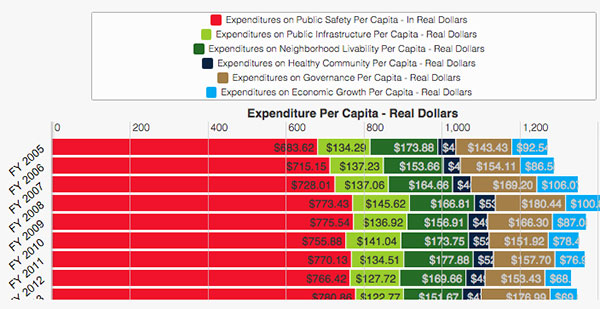

The other big money eater is public safety like police and fire, which amounts to about $780 per capita. Public safety makes up 42 percent of combined city budget funds and 74 percent of the general fund.

The credit rating groups, which give the city an AA rating, don’t like the high level of debt but say it is managed well, Queen said.

But what strongly concerns them is a state requirement that city voters renew the earnings tax every five years.

That tax brings in 40 percent of the general fund.

If voters do not renew it, officials cited one nasty option to make up the lost revenue: a 2 percent property tax increase combined with a one-cent sales tax and with citizens paying for trash pickup.

And those tax increases would have to be approved by the state and by voters.

It is best for the city bond rating and city borrowing costs if the voters approve the e-tax next year, she said.

“Then the rating agencies can stop talking to us about it for about four years,” she said.

Who’s talking